“How did we get to this point?” It’s a question that we read and hear all the time, and certainly, most of us have asked it at some time in the last three years. How did it come to the point where insurance doesn’t seem capable of taking the upper hand in the race between risk and profit?

The world and the economy have handed insurers a tough equation. Today’s business is navigating so many adverse circumstances and risk-related variables that it almost seems like an impossible equation. Can actuaries, underwriters, and business leaders get back on top and win the combined ratio game?

The issue becomes much larger when we look at trends. Risk is trending — and it is trending in the wrong direction regarding most variables. Let’s look at just property risk for a moment. The number of claims is rising. Repair costs are rising because of the rise in materials. Inflation is adding its own little tax onto each repair. Severe convective storms are among the most common and most damaging natural catastrophes in the United States with damaging wind, hail, rain, and tornadoes. And they are rising in numbers, intensity, and severity. How can insurance risk management programs help insurers make steady improvements?

At the same time, the industry is increasingly using insurance data and analytics tools like we had only dreamed of in the past. Our sources of data far eclipse anything we were using in the past to make decisions. AI and ML made early moves and GenAI was only a promise for us a few years ago. Today, they are beginning to conquer some of our toughest business hurdles. Machine Learning has been learning! It is helping insurers avoid costly risks, coaching policyholders to make sensible changes and it is dramatically improving the claims process.

However advanced technology can’t have an impact if it isn’t used, and it can only impact combined ratios if legacy technology and tech debt are simultaneously addressed. In Majesco’s recent Core Systems Report, Realignment in Insurance: Legacy Core Impact, we found that current business operating models and technology frameworks no longer meet the challenges, demands, and opportunities of today’s dynamic, fast-changing, and risk-filled world, let alone tomorrow’s.

For insurance risk management to improve enough to positively impact underwriting profitability and customer value, technology must be applied directly to those areas that can prevent, mitigate, or reduce claims. If an insurer understands its direction and its competitive differentiators, technology can support its risk philosophy, expand opportunities to understand risk, and maximize profit potential. That’s the business side of technology. It can make a difference to your operational model today.

Renew the focus on risk management.

For several years, the insurance industry has been focused (and rightly so) on the customer experience. Our ability to give customers an excellent experience needed to improve at the same rate that customer experiences were improving in other realms of business and life. Most insurers have come a long way in creating relevant experiences for customers. We still need to work on the customer experience and we especially need to look at the customer expectation gap in product development, which has a strong correlation to the urgent need to focus on risk management, because customer risks are changing and they need new products and options to help manage their risk and protect their assets. After all, risk prevention and risk pricing are central to customer care.

Providing products to cover risk is the core of insurance. Providing the right products and then assessing and managing that risk becomes a key competitive differentiator for insurers, with pricing, rating, and underwriting at the heart of the business. In the face of rapidly changing risk, it is increasingly crucial to have capabilities for evaluating individual risks, the exposures in an entire portfolio, risk appetite, and ultimately, profitability.

Market leaders are developing and launching products that leverage new data sources including telematic, behavior-based, parametric, and even embedded value-added services that help mitigate or manage risk. Product leaders are leveraging predictive analytics, creating multivariate rating algorithms, extending rating capabilities to channels and customers, and updating rates more frequently to keep up with the shifts in risk.

However, some of these advances are not as impactful due to the lagging transformation of core systems, many of which are on-premise, highly customized, and using older technologies. Many insurers are still using multiple policy systems due to legacy, acquisitions, new business model launches, or lack of moving business to a next-gen native cloud solution. As a result, stand-alone enterprise ratings such as Majesco’s P&C Enterprise Rating, are increasingly utilized to externalize the rates, rules, and logic associated with a product and bring consistency to the full enterprise. Enterprise rating also ensures the ease of rapid and regular updates, flexibility, and efficiency, and it enhances an insurer’s speed-to-market. (For more on this, be sure to watch Majesco’s recent webinar, Today’s Holy Grail: Pricing, Rating and Underwriting Speed and Flexibility.)

With the shifting and growing risk environment and products to cover those risks, reinsurance programs, and pricing are increasing in importance for insurers to cover uncertainties in books of business, to alleviate concentrated exposures, or to free up capital for other strategic needs. Having a better understanding of the risk within the portfolio can help drive improved reinsurance prices, positively impacting customer pricing and insurer profitability.

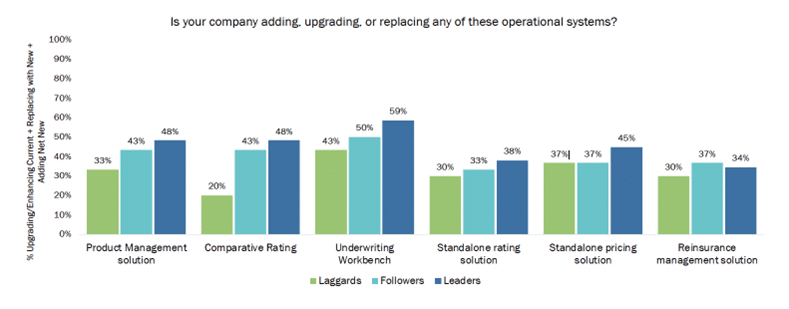

Because of the increased focus on risk with products, rating, pricing, underwriting, and reinsurance, one would expect a strong focus on improving operational capabilities in all these areas. Shockingly, over 50% have no plans to add, upgrade, or replace these key solutions as shown in Figure 1.

While Leaders outpace Laggards and Followers, the lack of attention to these areas is extremely concerning, particularly given that so many are still on legacy core and need some immediate help in meeting the risk and product demands within the market, and in focusing on profitability.

Figure 1: Insurers level of activity replacing and/or upgrading operational systems by Leaders, Followers, Laggards

Pricing, rating, and underwriting solutions increasingly play a critical role in delivering rapid updates and new products to market, from IoT-enabled products to Gig economy, on-demand, and telematic products, to name a few. The demand for more regular updates for pricing, from real-time to weekly, monthly, or quarterly rather than annually, is increasingly important in a world of increasing, changing risk and will become mainstream.

Take a proactive stance on loss with predictive analytics in insurance

With risk growing and becoming more complex and frequent, the adage of “control what you can control” is now front and center for insurers with new risk management strategies for underwriting and customer service. Focusing priorities to better assess risk, underwrite profitably, and prevent, or minimize losses is now increasingly important.

No longer is loss control just for complex and high-risk scenarios. It is increasingly being used across a broader swath of submissions for both personal and commercial lines of business by leveraging self-service loss control, automation, and advanced analytics to drive broader portfolio profitability.

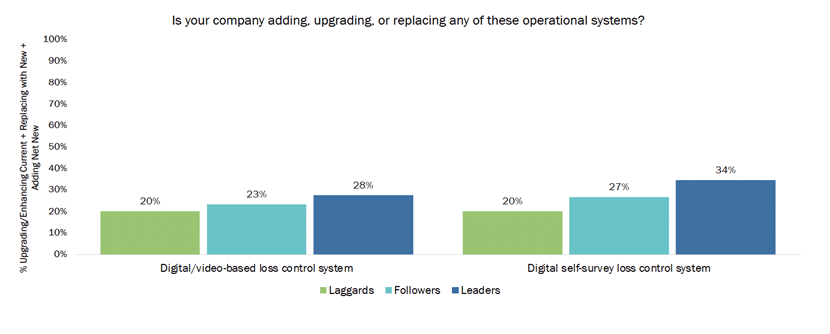

This is reflected in Figure 2, with 24% focused on upgrading, adding, or replacing digital video-based loss control systems and 27% for digital self-survey loss control solutions. Both options provide expanded capabilities to reach a broader part of a property portfolio cost-effectively, either with loss control specialists or customers, through these digital options. Loss control solutions, like Majesco’s Loss Control, are next-gen predictive analytics engines that solve multiple business issues through the use of AI and machine learning. They dramatically improve insurance risk management at the same time they save thousands of hours each day with their self-service capabilities and their analytic abilities. They make complex decisions and see potential issues, often without human interaction and travel time. They help place good business on the books quickly and simply.

Figure 2: Development of loss control systems, by Leaders, Followers, Laggards

We also found in the survey that 50%-56% of larger (Tier 1-2) and smaller insurers (Tier 3-5), respectively, use in-house loss control adjusters, as compared to outsourced adjusters, 26%-40%, respectively. Given the cost for either in-house or outsourced adjusting, the ability to use digital tools directly with customers allows insurers to reach a broader swath of risk while also engaging the customer to help understand the risk in the process.

Let risk drive your business …in the direction you need to go anyway.

There’s no arguing with risk. It exists and isn’t going away. It may wane or it may grow, but its results will always impact an insurer’s bottom line. In some ways, however, it’s okay to let risk push us into the areas we need to move, such as improving loss control, underwriting, and reinsurance capabilities and developing new insurance products that fit the real world of risk. The more we know about risk, the easier it is to avoid and manage. If risk pushes us to improve our processes, that’s great. If it drives us to seek new tech solutions, even better. An insurer’s goal must be to always keep business risk as predictable as possible and as manageable as technology will allow.

How far can insurance risk management software take your organization into the future? Can you turn new risks into new products? Can your organization use AI and Machine Learning to identify risks on the horizon? See how Majesco is changing the rules of P&C insurance by watching the Majesco webinar, Building the Intelligent P&C Core: Empowering Architecture with Embedded Analytics & GenAI on June 27, 2024, at 12:00 PM EDT.

The post Intelligent Insurance Risk Management Can Enhance Profits appeared first on Majesco.