CB Insights’ Key Trends in Financial Institutions’ Adoption of GenAI – Fintech Schweiz Digital Finance News

Around the world, financial services and insurance firms are deploying generative artificial intelligence (genAI) across a wide range of functions, products, and services, seeking increased efficiencies and improved customer experience.

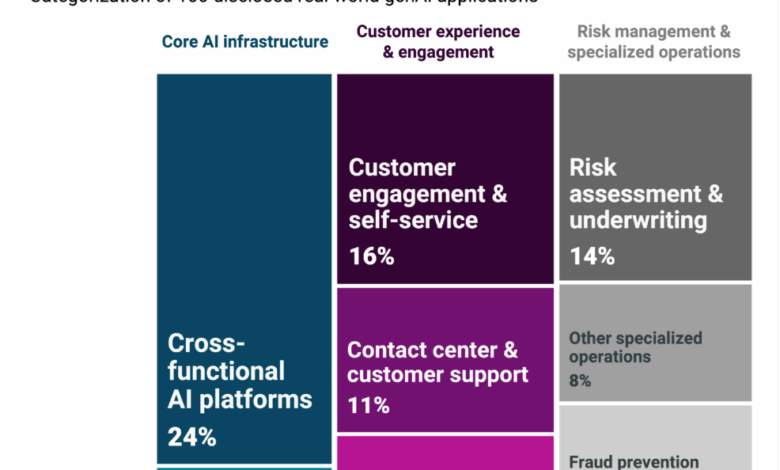

A new analysis by market intelligence CB Insights identified 100 real-world applications of genAI across 69 companies in banking, financial services, insurance, and payments, categorizing these applications into three main areas: core AI infrastructure, customer experience and engagement, and risk management and specialized operations.

The analysis uncovered several trends in how financial institutions are adopting genAI, including the rise of cross-functional AI platforms, the prevalence of customer engagement and self-service applications, and the dominance of OpenAI and Microsoft in the genAI space.

Cross-functional genAI platforms

According to the study, many financial services firms are prioritizing general-purpose genAI platforms. 24% of the 100 use cases identified focus on cross-functional genAI platforms, providing foundational genAI capabilities to employees across departments, and reflecting an emphasis on establishing the infrastructure for comprehensive AI adoption.

A notable example is Klarna, the buy now, pay later (BNPL) company. Klarna has made ChatGPT Enterprise available to all its employees around the globe, with 90% of its workforce now using AI in their daily work. Adoption is widespread across departments, with communications, marketing, and legal teams seeing rates of 93%, 88%, and 86%, respectively, and a wide range of use cases being deployed, from building software to streamlining customer service.

In February 2024, Klarna also separately launched an AI-powered assistant powered by OpenAI. The tool is designed to enhance the shopping and payments experience for Klarna’s 150 million consumers worldwide, and is capable of managing a range of tasks from multilingual customer service to managing refunds and returns, and promoting healthy financial habits.

Within a few months, the assistant handled 2.3 million conversations, two-thirds of Klarna’s customer service chats, and cut average resolution times from 11 minutes to just 2. The initiative is projected to deliver US$40 million in profit improvement in 2024, all while maintaining satisfaction scores on par with human support.

Other institutions that have implemented cross-functional genAI platforms include BNP Paribas, which has partnered with Mistral AI since September 2023 to deploy large language models for banking applications across customer service, sales, and IT; JP Morgan, which leverages AWS to support over 1,000 applications and 200,000 employees; and BBVA, which partnered with OpenAI in November 2024 to deploy 3,000 ChatGPT Enterprise licenses among its employees in Spain, with plans to extend this to other countries.

Customer-facing genAI applications rise to prominence

Customer-facing genAI applications, especially those focused on engagement and self-service, are also gaining traction. These genAI applications, which are used by customers to interact with a company, account for 16% of the 100 identified genAI applications in finance and insurance.

Institutions including ING, Wells Fargo, and Truist demonstrate the potential of these solutions to handle millions of customer interactions.

ING launched in September 2023 a genAI chatbot developed with McKinsey. The solution is designed to improve customer experience, and has helped 20% more customers avoid long wait times. ING aims to support 37 million customers across 40 countries with its genAI chatbot.

Truist Financial, an American financial services company, introduced in 2022 Truist Assist, a virtual assistant that’s capable of answering more than 160 common client inquiries, such as locking and unlocking credit cards. Truist Assist supported over 1 million client conversations in Q1 2025, with over 80% resolved without human intervention, reflecting improved efficiencies.

Wells Fargo launched in 2022, Fargo, a virtual assistant that helps customers with everyday banking needs via voice or text, handling requests such as help paying bills, transferring funds, providing transaction details, and answering questions about account activity. The tool, which uses Google’s conversational AI Dialogflow, handled 245.4 million interactions in 2024, more than doubling its original projections, Venture Beat reported.

CB Insights expects the adoption of customer-facing genAI applications to accelerate as companies like Mastercard, Visa and PayPal deploy applications centered on so-called “agentic commerce,” where AI agents autonomously execute transactions on behalf of consumers.

In April 2025, Mastercard announced the launch of its agentic payments program, Mastercard Agent Pay. The solution integrates AI-driven agentic commerce with secure payment technology, allowing AI agents to act on behalf of consumers or businesses, and make purchases, manage subscriptions, and handle transactions. Visa and PayPal are also experimenting with agentic AI solutions, with Visa testing automated consumer query responses, DigFin reported in June, while PayPal has just announced that it would process payments for automated shopping developed by the conversational search and discovery engine Perplexity, enabling users to buy products or services directly in Perplexity’s chat interface.

OpenAI, Microsoft lead genAI landscape

The analysis also revealed that OpenAI and Microsoft lead the genAI space, participating in 33% of the 100 genAI applications studied. OpenAI, the developer of ChatGPT, claims nearly 700 million weekly active users for its AI-powered chatbot, up from 500 million in March, marking a more than fourfold year-over-year (YoY) surge in growth. The figure spans all ChatGPT AI products, free, Plus Pro, Enterprise, Team, and Edu, and comes as daily user prompts reaches 2.5 billion.

OpenAI is the world’s second most valuable tech startup at US$300 billion, neck and neck with ByteDance, the owner of TikTok. The company is reportedly preparing to sell around US$6 billion in stock as part of a secondary sale that would value it at roughly US$500 billion, Bloomberg reported last week.

Microsoft is a major investor in OpenAI, having invested more than US$13 billion in the startup.

Featured image: Edited by Fintech News Switzerland, based on image by sitthiphong via Freepik